A much-needed law may have unintended global consequences

By Hans Eric Melin, Mohammad Ali Rajaeifar, Anthony Y. Ku, Alissa Kendall, Gavin Harper, Oliver Heidrich

Transport electrification is a key element of decarbonization strategies; thus, the design, production, manufacture, use, and disposal of lithium-ion batteries (LIBs) are taking center stage. The environmental, economic, and social consequences of the battery life cycle are high on political agendas, owing to exponential growth in metals extraction;

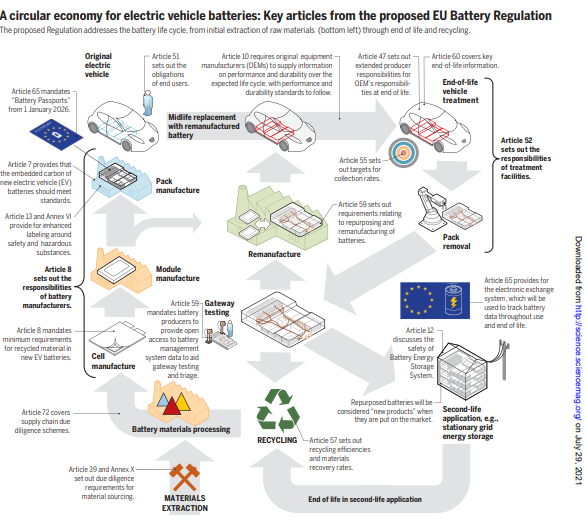

the climate impacts of battery production; and uncertainties in battery end-of-life (EOL) safety, recyclability, and environmental consequences (1) [see figs. S1 to S3 in the supplementary materials]. The European Union (EU) has proposed a new Battery Regulation (2) that intends to ensure sustainability for batteries placed on the EU market (see the figure), developing a robust European battery industry and value chain. The Regulation is very much needed, but, as discussed below, it will have global implications, with perhaps some unintended consequences. If left unaddressed, the Regulation, at worst, could hamper climate change mitigation targets and fall short of its intentions to promote a circular economy and establish a socially acceptable raw material supply chain. The proposed Regulation will build upon and replace the 2006 EU Battery Directive (3) to address this era’s challenges, stipulating labeling and information provisions, setting out supply chain due diligence requirements, and enforcing the use of recycled materials for batteries over 2 kilowatt-hours (kWh), most of which are used in electric vehicles (EVs). Historical data show an almost 10-foldcincrease of LIBs placed on global markets in the past 10 years (see figs. S4 and S5), and a similar growth rate is expected during this decade (see fig. S1). Therefore, it is imperative to address the global climate change challenge and battery issues in tandem (4–6). Despite being the second-largest market for EVs in the world, Europe does not dominate LIB supply chains, instead relying on global markets for raw material extraction, refining, and battery manufacturing (7).